Can Rolls-Royce Shares Reach £17 or Even £25 in 2026? A Comprehensive Analysis

Rolls-Royce (LSE:RR.) has experienced an extraordinary surge in its stock price over the last few years, with impressive gains attracting both retail and institutional investors. With the stock continuing its impressive run and a strong performance in 2025, many are now wondering: can Rolls-Royce shares hit £17 or even £25 by the end of 2026? Let's explore the company's growth potential, drivers, and challenges to gauge the likelihood of these predictions coming true.

Key Points Summary:

Rolls-Royce shares have surged 1,133.4% since 2023, with 95.4% growth in 2025.

Key drivers of growth include aerospace recovery, increased defense spending, and small modular reactors (SMRs).

Some analysts predict a 40.4% gain in 2026, while others are cautious due to high valuation.

Risks include unproven SMR technology, potential defense spending slowdowns, and broader economic factors.

While £17 or £25 targets are possible, they require strong performance in multiple areas.

advertisement

A Remarkable Recovery

Rolls-Royce shares have seen an explosive turnaround, particularly since 2023. Over the past few years, the company’s stock price has skyrocketed, with gains of 1,133.4% since the start of 2023 alone, and an eye-popping 95.4% increase in 2025. These exceptional returns have brought Rolls-Royce’s valuation to new heights, with its market capitalization approaching £97 billion. But can it continue this upward trajectory?

According to some analysts, Rolls-Royce shares could reach new heights in 2026, potentially hitting £17 or even £25. However, there are several factors that could influence whether these targets are achievable.

Key Drivers of Growth

1. Civil Aerospace and Air Travel Growth

Rolls-Royce’s civil aerospace division, which represents the largest source of revenue for the company, continues to show robust growth. In 2025, the division saw a year-on-year revenue increase of 17%, driven by the continued recovery in global air travel. In fact, passenger traffic is expected to rise by 4.9% in 2026, which could result in even higher demand for aircraft engines.

2. Defense Contracts and Increased Military Spending

Another significant contributor to Rolls-Royce's potential for growth is its defense division. With geopolitical tensions increasing and NATO countries raising defense budgets, Rolls-Royce stands to benefit from higher spending on military hardware, such as fighter jets and naval submarines. These contracts have the potential to boost Rolls-Royce’s earnings, especially if defense spending continues to increase globally.

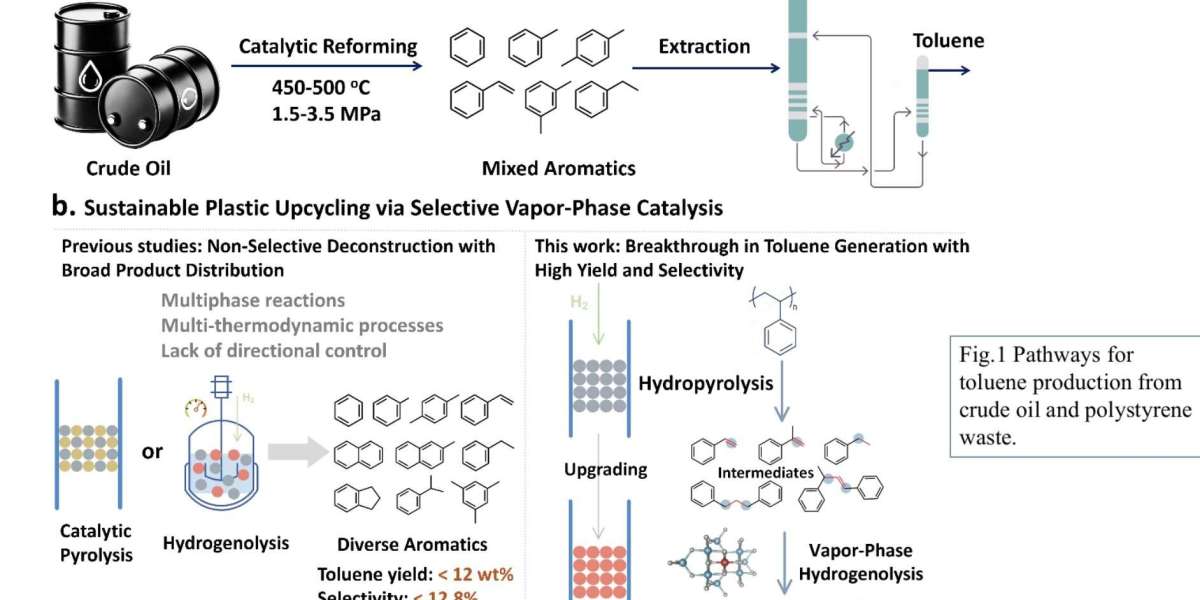

3. Modular Nuclear Reactors (SMRs)

Rolls-Royce has also been making waves in the nuclear energy sector, particularly with its small modular reactors (SMRs). The company has already secured agreements with governments like the UK and the Czech Republic to provide these reactors, which promise cleaner energy with fewer environmental impacts than traditional nuclear plants. SMRs could play a huge role in Rolls-Royce’s future, with 400 reactors expected to be required globally by 2050, potentially generating $3 billion each.

4. AI and Data Center Powering

With the rise of artificial intelligence (AI) and the ever-growing need for data centers to support AI technologies, Rolls-Royce’s investments in energy systems for these facilities could offer another avenue for growth. The company's power division has already seen a 20% increase in revenue, and as AI demand surges, Rolls-Royce’s ability to supply energy to these data centers could further boost its earnings.

advertisement

The Challenges and Risks

While the growth potential for Rolls-Royce is undeniable, there are several risks that could hinder the company’s stock price performance.

1. Valuation Concerns

One of the main concerns surrounding Rolls-Royce shares is their current high valuation. At a price-to-earnings (P/E) ratio of 36.5, the stock is already considered expensive. If Rolls-Royce shares were to rise another 47.9% to £17, as some forecasts suggest, the P/E ratio would become even more stretched, making the stock less attractive for value investors. Additionally, the company’s earnings are forecast to grow by just 15.8% in the next year, which may not be enough to justify the high valuation.

2. Uncertain SMR Technology

While SMRs represent a significant growth opportunity, the technology is still in its early stages, and its effectiveness has yet to be proven on a large scale. If the SMR initiative fails to meet expectations, it could negatively affect the company’s stock price.

3. Potential Slowdown in Military Spending

Although defense spending has been a major growth driver for Rolls-Royce, any slowdown in military expenditure could impact the company’s earnings. Furthermore, if global conflicts were to ease or military budgets shrink, it could reduce the demand for Rolls-Royce’s defense products.

4. External Economic Factors

Rolls-Royce’s performance is also susceptible to broader economic conditions. For example, a downturn in the global economy or a reduction in air travel due to unforeseen circumstances could negatively impact the company’s aerospace division.

advertisement

Expert Opinions on Rolls-Royce’s Stock

The Bullish View

Analysts from institutions like Bank of America remain optimistic about Rolls-Royce’s future, projecting strong earnings growth and an increase in free cash flow throughout 2026 and beyond. Their updated share price target of £16.15 suggests a potential 40.4% gain from current levels, although it falls short of the £17 target predicted by others.

The Cautious Perspective

On the other hand, some analysts, including those from Berenberg Bank, Citigroup, and JP Morgan, are less optimistic. They suggest that the stock is already priced in line with expectations, meaning that the current share price might not see substantial gains in the near term. These analysts foresee a price range of £11 to £12 for Rolls-Royce shares in the next 12 months.

Can Rolls-Royce Hit £25 by 2026?

A target of £25 is certainly a stretch, and no analysts are currently projecting this level of growth. However, if Rolls-Royce continues to exceed expectations in key areas like defense contracts, air travel, SMRs, and energy for data centers, it’s not entirely out of the realm of possibility. That said, such an outcome would require the company to outperform in several key areas, and any failure to meet those expectations could lead to a correction in the stock price.

Conclusion: A Promising, Yet Risky Investment

Rolls-Royce’s stock has undeniably been one of the best-performing on the London Stock Exchange in recent years. The company’s strong presence in aerospace, defense, and energy sectors, combined with its innovative ventures in SMRs, makes it an exciting growth story. However, its high valuation and the inherent risks associated with some of its new ventures should make investors proceed with caution.

For those willing to take on the risks, Rolls-Royce offers an intriguing investment opportunity, but expectations should be tempered. While reaching £17 or even £25 may be possible, it is far from guaranteed.

FAQ:

1. Why have Rolls-Royce shares been performing so well in recent years?

Rolls-Royce has benefitted from a recovery in air travel, increasing military contracts, and investments in emerging technologies like small modular reactors (SMRs) and energy systems for data centers.

2. Can Rolls-Royce shares reach £17 or £25 by 2026?

Some analysts predict that Rolls-Royce shares could rise to £17 or even £25 if the company continues to exceed expectations in aerospace, defense, and energy sectors. However, there are significant risks, including the high valuation and potential challenges in emerging technologies.

3. What are the risks of investing in Rolls-Royce?

Risks include the unproven effectiveness of SMR technology, potential slowdowns in defense spending, and broader economic downturns that could affect Rolls-Royce’s key markets.

Sources:

MSN.com - Could Rolls-Royce Shares Surge by Another 100% in 2026?

Yahoo Finance - How Rolls-Royce Shares Could Hit £25 in 2026

Thank You & Happy New Year!