Nvidia Stock Predictions for 2026: A Leader in AI, But Competition is Heating Up

Nvidia (NVDA) has firmly established itself as a leader in the artificial intelligence (AI) chip market, especially in the booming field of AI-powered data centers. Its GPUs have become the backbone of AI systems used by tech giants, and the company has enjoyed remarkable growth. However, as we head into 2026, there are emerging challenges and exciting opportunities that could shape Nvidia’s trajectory in the stock market.

advertisement

AI Boom: Nvidia's Dominance and the Increasing Competition

Nvidia’s GPUs have been instrumental in powering AI models for companies like Google, Microsoft, and Amazon. As demand for AI computing power grows, Nvidia’s role as the dominant player in AI hardware continues to attract massive investments. According to analysts, the AI infrastructure market is set to grow exponentially, with global spending expected to hit $3-4 trillion by 2030. This provides Nvidia with a substantial runway to continue scaling its data center business.

Despite Nvidia’s leadership, there are concerns about rising competition. Companies like AMD, Broadcom, and Amazon are all investing in custom chips for AI workloads. Nvidia’s dominance has led to speculation about whether it can maintain its edge, especially as other players enter the market with new innovations.

Yet, Nvidia is not sitting idly by. The company has recently entered a strategic partnership with Groq, an AI-chip startup, acquiring key executives, including CEO Jonathan Ross, to help advance and scale inference technology. This move strengthens Nvidia’s position in the highly competitive AI inference space, which has become increasingly important for real-time AI applications. The deal reflects Nvidia’s ongoing commitment to maintaining its leadership in AI hardware while expanding its capabilities.

advertisement

Nvidia’s Stock Valuation and Growth Potential

Nvidia has seen its stock price soar in recent years, driven by strong earnings reports and the insatiable demand for AI hardware. However, some analysts are cautious about the company’s valuation. As of late 2025, Nvidia’s stock is trading at about 23 times next year’s earnings, which is considered a reasonable valuation by many. This provides a favorable entry point for investors who believe in the company’s long-term growth potential.

Despite the competition and potential valuation concerns, Nvidia's stock remains attractive for 2026, particularly as AI hyperscalers (large companies building out AI infrastructure) continue to spend heavily on data centers. Nvidia's CEO Jensen Huang recently confirmed that the company is "sold out" of cloud GPUs, a sign of how high the demand for its products is. With the continued ramp-up in AI data center buildouts, Nvidia looks set to capitalize on massive growth in the AI market.

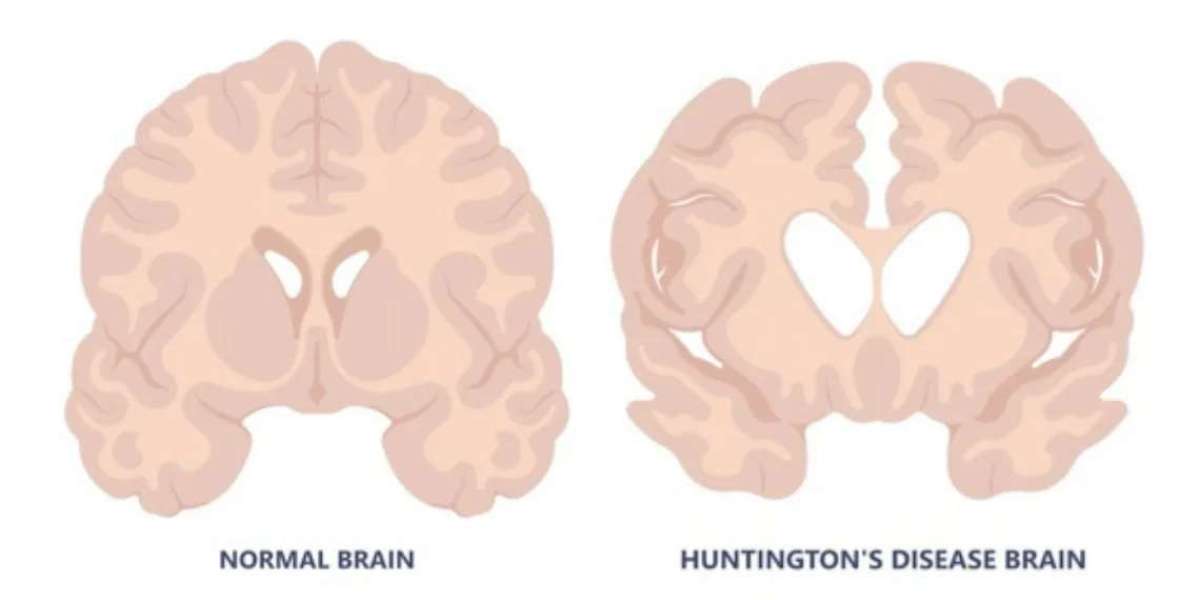

Micron: A Competitor to Watch in the Semiconductor Space

While Nvidia remains a dominant force, Micron Technology (MU) is another semiconductor company that’s poised for tremendous growth. Micron manufactures high-bandwidth memory (HBM) chips, which are critical for AI workloads. Micron’s memory chips are used by companies like Nvidia, AMD, and Broadcom to power AI data centers. The growing demand for memory chips driven by AI has led to a shortage of these chips, pushing up prices and boosting Micron’s revenue.

Micron’s revenue surged 57% year-over-year in the first quarter of fiscal 2026, driven by the explosion in AI demand. With Micron expecting its HBM market to grow at 40% annually through 2028, the company could become a significant competitor to Nvidia in the AI space. Analysts project that Micron could see its stock price triple by 2030, highlighting its potential to outperform Nvidia in the next five years.

While Nvidia remains the leader in GPU-based AI processing, Micron’s success in the memory chip market is one of the key factors that could drive broader competition in the AI infrastructure sector.

advertisement

Nvidia’s Future: What Lies Ahead for 2026?

Looking ahead, Nvidia is positioned for continued growth, but the path will not be without challenges. The competition is intensifying, especially with Micron’s rise in the memory market and the increasing investment from other AI chipmakers. However, Nvidia’s strategic moves—such as its acquisition of Groq executives and its strong foothold in AI training and inference workloads—suggest that it will remain a leader in the AI hardware race.

Analysts remain largely bullish on Nvidia’s stock, with price targets ranging from $250 to $300 for 2026. Given Nvidia’s established market position, robust product pipeline, and significant market share in AI, its stock could continue to grow as long as demand for AI hardware remains strong.

Conclusion:

Nvidia remains a top pick for investors interested in the AI revolution, with strong growth potential heading into 2026. The company’s innovative GPU technologies and recent strategic partnerships position it well in a rapidly expanding market. However, the competition from companies like Micron could introduce new challenges that investors will need to monitor. If Nvidia can maintain its edge while adapting to an evolving competitive landscape, its stock could continue to deliver impressive returns.

Sources:

Thank you and Merry Christmas!