Tesla (TSLA) Stock: Navigating a New Era of Innovation and Investor Confidence

Tesla (TSLA) has remained one of the most talked-about stocks in recent years, and its recent performance continues to spark both excitement and caution among investors. As the company edges closer to breaking the $500 mark, several developments have caused its stock to surge, including advances in autonomous driving technology, legal victories, and the ongoing influence of major investors like Cathie Wood. However, not all analysts are as optimistic, with some revising delivery forecasts downward, raising questions about the company’s short-term outlook. Here's a closer look at what’s driving Tesla’s stock and the future prospects of this electric vehicle (EV) giant.

advertisement

Cathie Wood and Ark Invest: A Mixed Strategy

Cathie Wood, the well-known CEO of Ark Invest, has long been a supporter of Tesla’s vision, believing in the company’s potential to revolutionize the transportation industry. In fact, Tesla remains a top holding in Ark’s ETFs, including the ARK Innovation ETF (ARKK) and ARK Autonomous Tech ETF (ARKQ). However, in recent months, Wood has taken some profits from her Tesla holdings, selling over 60,000 shares for an estimated $29.7 million in December 2025. This move comes amid concerns over the company’s short-term delivery figures and the broader stock market conditions.

Wood’s decision to reduce her Tesla stock holdings has raised eyebrows, but she maintains a positive long-term outlook for the company, especially regarding its robotaxi ambitions. Ark Invest predicts that Tesla's stock could hit a whopping $2,600 by 2029, with autonomous ride-hailing services contributing to most of the company’s future value. This aligns with Wood's faith in Tesla’s ability to generate high-margin, recurring revenue from its evolving software-based services.

Analysts Weigh In: Mixed Forecasts on Deliveries and Valuation

While Tesla has seen impressive stock performance in 2025, there’s significant debate about its future delivery numbers. UBS, for example, has maintained a cautious stance, reducing its fourth-quarter delivery forecast to 415,000 vehicles, lower than its initial projection of 429,000. This reduction has been accompanied by a “Sell” rating and a price target of just $247 for Tesla’s stock, suggesting that the company might be overvalued at its current trading price of around $488.73.

On the other hand, some analysts, such as Canaccord Genuity, remain optimistic about Tesla’s future, raising their price target to $551 while maintaining a “Buy” rating. They see significant growth potential in Tesla's efforts to dominate the EV market, particularly as the company expands into emerging markets. The difference in perspective largely stems from varying expectations about Tesla’s short-term delivery performance versus its long-term innovation potential, especially with autonomous driving and AI technologies.

The Autonomous Revolution: Tesla’s Path Toward Full Self-Driving Cars

A key driver behind Tesla's recent rally is the growing confidence in its autonomous driving technology. Tesla has made significant progress toward achieving fully driverless cars, a crucial step in transforming its business model from just an EV manufacturer to a leader in autonomous mobility. In fact, the company recently began testing fully driverless vehicles in Austin, Texas, marking a major milestone toward its goal of creating a fleet of robotaxis.

Investor confidence in Tesla's autonomous vehicles has been further bolstered by real-world tests. During a recent power outage in San Francisco, where many robo-taxi services struggled to operate due to traffic signal failures, Tesla’s vehicles continued to function seamlessly, highlighting the reliability of its camera-based system. This performance has reinforced the idea that Tesla’s technology is not just viable but could outperform competitors in critical situations.

Furthermore, Tesla’s recent legal victory in Delaware regarding Elon Musk’s compensation package has helped stabilize investor sentiment. The Delaware Supreme Court overturned a lower court decision that had invalidated Musk’s 2018 pay agreement, providing much-needed clarity and reinforcing confidence in Tesla’s leadership. With Musk’s compensation structure now restored, investors can feel more secure in the company’s future.

advertisement

Tesla Stock: Pushing Toward $500

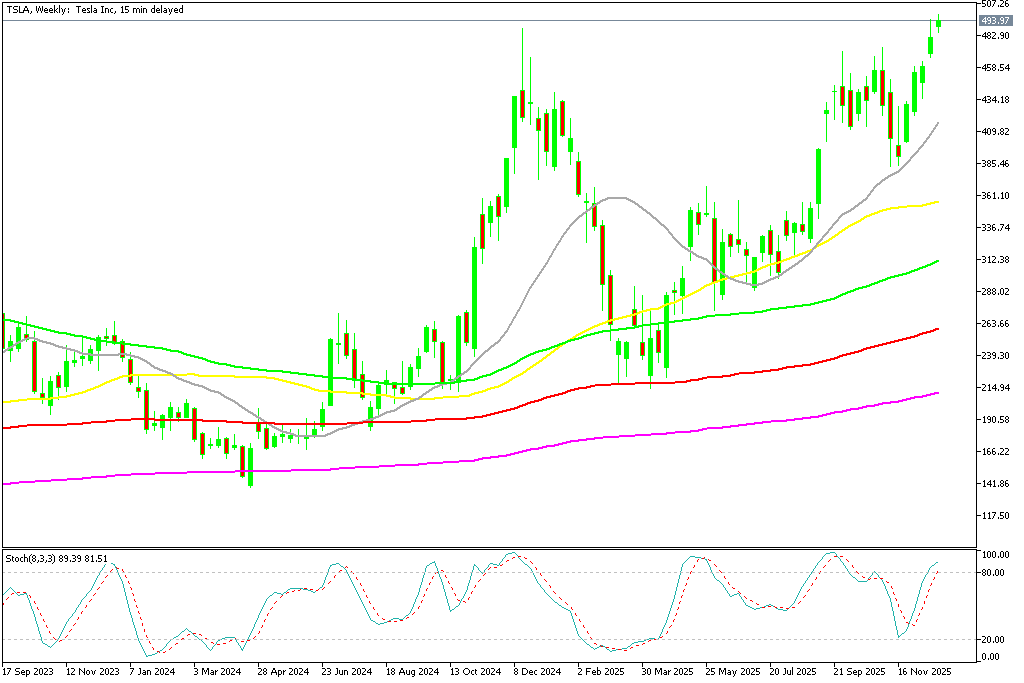

Despite mixed opinions from analysts, Tesla's stock has recently surged toward the $500 mark, an all-time high for the company. This surge is a clear indication that investors are not just buying into the company’s electric vehicles but are increasingly seeing Tesla as a tech company with immense software-led growth potential. The company's market capitalization has now exceeded $1.5 trillion, affirming its place as one of the most valuable firms globally.

Tesla’s recent stock rally has been largely fueled by the optimism surrounding its advancements in autonomous driving and AI technology. Since October 2025, the stock has risen by about 40%, signaling a shift in sentiment as investors increasingly focus on Tesla’s long-term opportunities rather than short-term challenges.

advertisement

Conclusion: Tesla’s Road Ahead

Tesla's future remains full of promise, but it is not without its challenges. The company is navigating a complex landscape of competition, regulatory hurdles, and market fluctuations. While short-term delivery forecasts may be cautious, the long-term outlook for Tesla is buoyed by its leadership in autonomous driving, AI, and battery technology.

As Tesla moves closer to full autonomy and continues to expand its market share, especially in emerging markets, the company’s transformation from a traditional carmaker to a software-driven mobility provider will likely set it apart. Investors who focus on Tesla’s innovation and disruptive potential are positioning themselves for what could be a new chapter in the company’s growth story.

For now, Tesla remains a top choice for those looking to invest in the future of transportation, but as with any rapidly evolving tech company, investors should be mindful of both the risks and the rewards.

Sources:

Thank you !