article image source: coindesk.com (link)

Dogecoin Price News: Can DOGE Rebound After Breaking Key Support Levels?

image: (CoinDesk Data) - source: coindesk.com

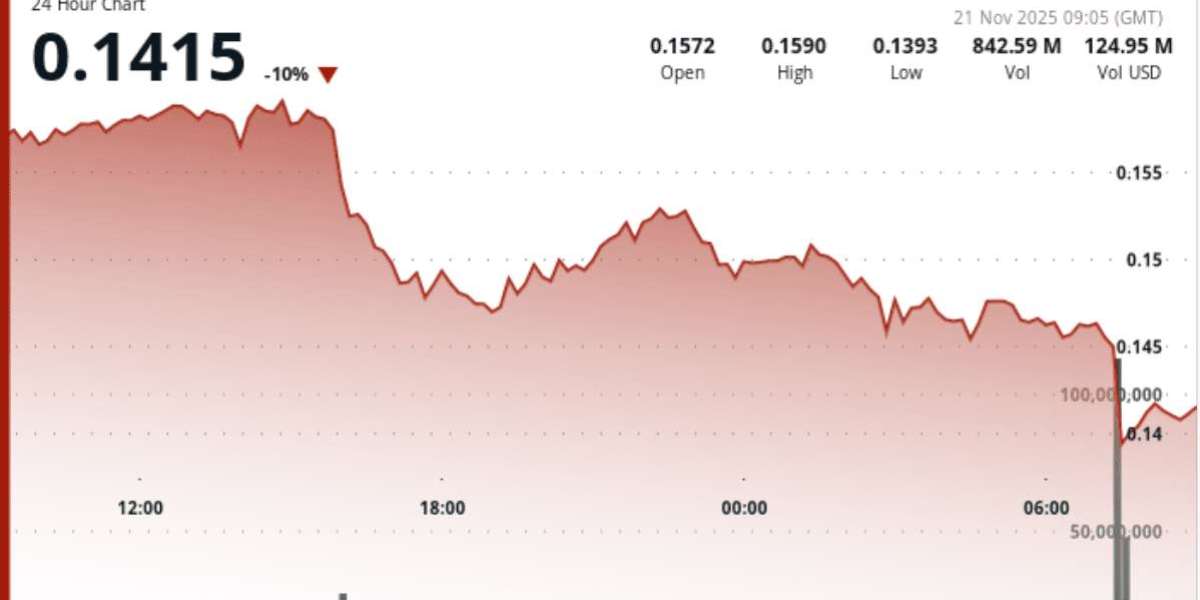

Dogecoin enters a turbulent phase as market volatility intensifies and key support levels begin to fracture. After sliding toward the $0.15 zone — a price many traders have been watching closely — DOGE now faces a defining moment that may determine whether December brings recovery or deeper decline.

Recent market stress, triggered in part by Bitcoin’s fall below $90,000 (and even below $85,000 according to some analyses), has weighed heavily on the memecoin sector. Liquidity has thinned, fear has intensified, and Dogecoin’s price behavior is now at the center of market discussions.

advertisement

Dogecoin Battles at the $0.15 Support

Dogecoin’s decline to the $0.15 region has highlighted the ongoing bearish pressure. Over the past week, the coin has lost nearly 9%, moving between $0.1533 and $0.1625 in choppy trading conditions. Technical indicators show DOGE fighting to hold above the Fibonacci 0 level at $0.15178, although an RSI near 39 continues to signal bearish momentum.

Analysts note that the earlier loss of support at $0.1720 exposed the $0.1650–$0.1600 range, with the weekly 200-EMA around $0.16 acting as an important final defense before larger structural declines.

However, another perspective points out that DOGE has already broken below the $0.15 floor, establishing fresh support around $0.138. This view emphasizes that Dogecoin’s chart has now turned fully bearish, with multi-level support failures confirming a deteriorating trend.

Whale Behavior and Market Signals: Mixed Indicators

Despite the broader downturn, some indicators offer hints of early accumulation:

Exchange net positions for DOGE recently turned positive — historically a sign of accumulation phases beginning.

Whales acquired more than $8 million worth of DOGE over three days, with an additional $9 million entering long futures positions.

However, alternative analysis shows that whale accumulation slowed sharply after the recent crash, suggesting caution among large players following weeks of aggressive buying.

Money Flow indicators show slight improvement at support levels, indicating dip-buying activity is returning — but net spot outflows remain mildly negative, showing confidence hasn’t yet fully recovered.

Analyst Ali Martinez also highlights a massive historical support at $0.08, where over 27.4 billion DOGE were accumulated. While far from current levels, it represents a strong long-term demand zone should the market face deeper capitulation.

A Technical Breakdown: Oversold, High Volume, and Trend Damage

DOGE’s recent move downward has been marked by:

An 11.2% drop from $0.1578 → $0.1401

Volume surging to 2.52 billion — 263% above the 24-hour average

A sharp selloff from $0.144 → $0.138 during a high-activity window

Repeated lower highs and lower lows confirming ongoing bearish structure

The decline appears driven more by technical failures than fundamental news. A rejection at $0.1595 set off algorithmic or institutional selling, triggering multiple rapid gaps downward.

DOGE now trades below both its 50-day and 200-day moving averages, with both trending downward — a traditional signal of sustained weakness. Momentum indicators show deep oversold conditions, though without bullish divergences that would suggest a reversal.

December Outlook: Recovery Possible — but Only Above Key Levels

Dogecoin now sits at a high-risk inflection zone. For a sustainable recovery, the following levels are crucial:

Bullish Scenario (if support holds or reclaims)

Holding $0.15 or reclaiming $0.144 strengthens chances for a rebound.

Upside resistance targets include $0.1654, $0.1738, and $0.1807.

A decisive breakout above $0.20 could open the door to a broader December recovery.

Bearish Scenario (if support fails again)

Losing $0.138 exposes DOGE to quick drops toward $0.135 and $0.128.

Broader targets include $0.095 and even $0.059, depending on overall market sentiment.

Weak whale activity and fragile crypto conditions add risk, especially if Bitcoin continues to decline.

Different sources emphasize different levels of urgency: some view $0.15 as the make-or-break zone, while others argue that DOGE has already broken that support and must now defend $0.138 to avoid deeper losses.

Conclusion

Dogecoin’s current position is both precarious and potentially pivotal. The memecoin stands at the crossroads of technical weakness and emerging signs of accumulation. While charts point to a clear bearish trend, long-term demand zones and returning whale interest offer a glimmer of optimism.

Investors will closely watch whether DOGE can reclaim lost ground or establish a stable base at its new support. December may deliver clarity — whether through renewed memecoin momentum or a deeper correction that tests the resilience of long-standing holders.

In a market driven by sentiment, liquidity, and rapid shifts in confidence, Dogecoin’s next big move will likely come from a decisive break of either support or resistance. Until then, caution and patience remain essential.

Sources

Thank you !