article image source: freepik.com (link)

Global Markets on Edge: The Interplay of Tech Valuation, Crypto Volatility, and Trade Policy

A distinct atmosphere of caution has recently descended upon global financial markets. From benchmark stock indices to the volatile realm of digital currencies, investors are reacting to a combination of high-stakes corporate news, shifting macroeconomic expectations, and deep structural questions about future economic growth.

advertisement

The AI Stock Sell-Off: A Healthy Correction or Bubble Warning?

Global equities have experienced a pronounced slide, with major indices across the US, Europe, and Asia all moving into negative territory. This sell-off is largely centered around the technology sector, fueled by ongoing chatter about a potential bubble in the artificial intelligence (AI) space.

The market is holding its breath ahead of crucial third-quarter earnings from companies like Nvidia, which serves as a bellwether for the entire AI industry given its dominance in supplying the essential Graphics Processing Units (GPUs). This dependency means the company's results and outlook are key indicators of whether the massive investment flowing into AI infrastructure is sustainable.

Many analysts, however, are characterizing the current decline as a natural and healthy correction rather than the start of a major bear market. After a strong market run, a brief period of "profit taking" is normal. Furthermore, a major sell-off often requires signs of market "froth," such as extreme M&A or IPO activity, which has been subdued on a longer-run horizon. The current skepticism is viewed as a necessary rebalancing, as investors realize the mega-deals announced over the summer—including massive commitments to data center spending by companies like OpenAI—will require significant and potentially slower funding through credit markets and vendor financing.

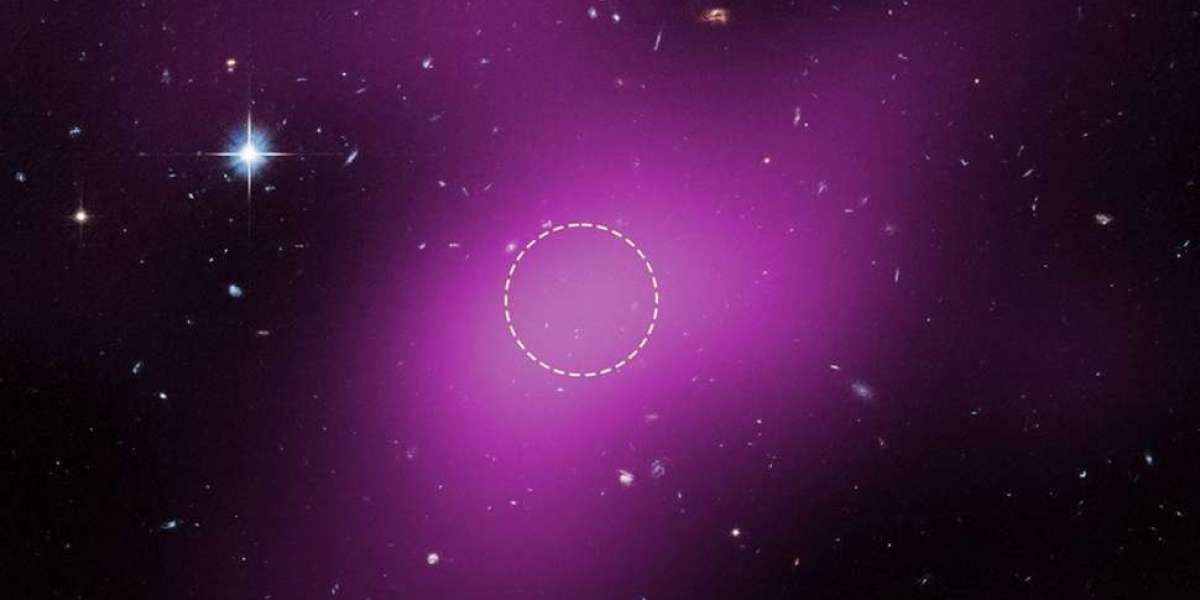

Cryptocurrency Market Panic: Below Key Levels

The general risk-off sentiment in traditional markets has been amplified in the hyper-leveraged cryptocurrency space. Bitcoin price crashed below the psychological $90,000 mark for the first time in seven months, pushing the market’s Fear & Greed Index into "extreme fear."

The primary drivers of this crash include:

Technical Breakdown: Bitcoin failed to reclaim the critical $92,000 support level, triggering a sharp shift in market mood.

Liquidation Cascade: The break below $90,000 led to a flood of forced liquidations, wiping out over $1 billion for more than 180,000 traders in a 24-hour period.

Fading Institutional Demand: Spot ETF outflows—including significant withdrawals led by major institutional funds—have added extra pressure, weakening one of the market's strongest sources of support from earlier in the year.

The drop has been even more severe for the pioneer altcoin, Ethereum (ETH), which has dropped around 35% from its earlier high. Despite the prevailing FUD (Fear, Uncertainty, and Doubt), some analysts remain bullish, pointing to repeating chart patterns seen in previous bull cycles that triggered massive price comebacks. They argue that the fundamentals of growth in the crypto space are experiencing a heavy disconnect from current asset prices, suggesting the potential for a new "price discovery" phase for Ethereum if substantial liquidity returns.

Macroeconomic Uncertainty and Global Trade

Adding to the complexity are macro-level uncertainties that are causing investors to de-risk portfolios:

The Federal Reserve and Rate Cuts: Uncertainty surrounding the previously expected timing of a Fed rate cut has frozen investor confidence. Analysts now suggest the central bank will likely pause action in the near term, eliminating a key driver that typically encourages risk-taking.

US Tariff Policy: A significant source of trade uncertainty stems from the US Supreme Court's pending ruling on the legality of certain reciprocal tariffs. This is viewed as a 50-50 call, with the outcome determining the scope of the Executive Branch’s power to impose such duties and potentially setting the stage for renewed trade drama.

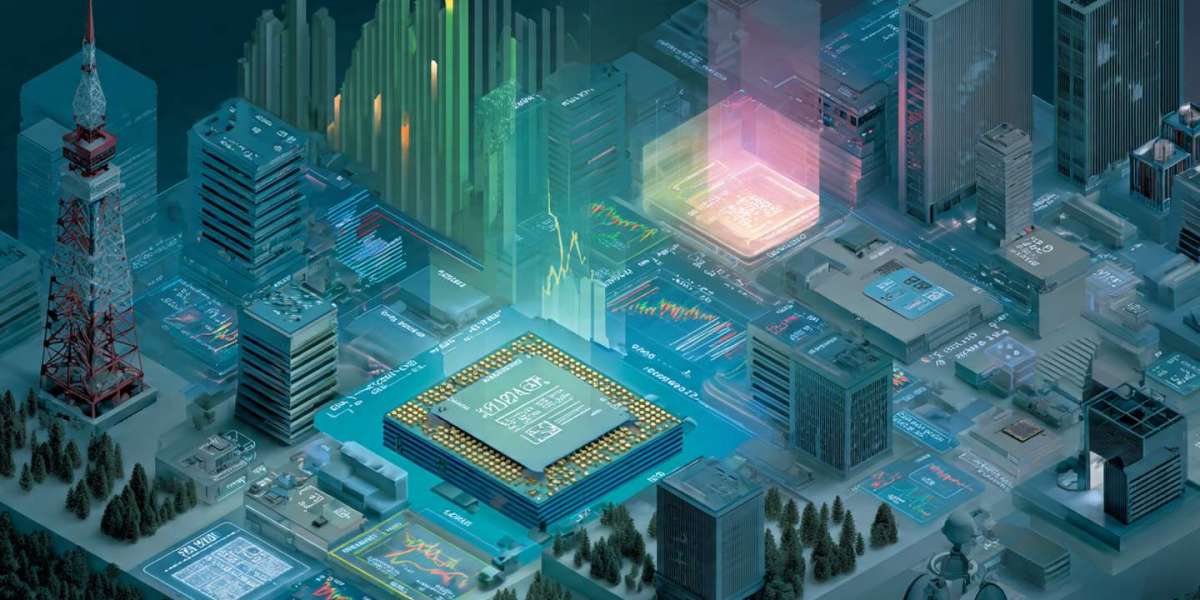

A Bottleneck for the Future: The Power Problem

Looking beyond short-term volatility, a looming long-term bottleneck threatens to slow the entire AI revolution: access to electricity and power.

The build-out of massive, energy-intensive data centers requires colossal amounts of electricity. Industry executives are realizing that providing the necessary power to run these new AI infrastructure hubs is a significant and potentially slowing problem. The issue of securing resilient, sustainable power is now a central business challenge that will influence the pace of data center construction and, by extension, the speed of technological development across AI, electric vehicles, and other industrial sectors. This critical infrastructure challenge demands a multi-year strategic view and is arguably the biggest obstacle to continued exponential growth.

Conclusion: Navigating Turbulence to Build the Future

The current financial landscape is a snapshot of deep transition. The recent market turbulence—from the tech correction to crypto volatility—is not merely a test of investor nerves, but a crucial moment of recalibration. On one hand, it's forcing a necessary reassessment of value in the hyped AI sector, ensuring that investment is tied to realistic revenue generation rather than pure speculation. On the other hand, it highlights the heavy interconnectivity of all asset classes, where fear in one market, magnified by political and trade uncertainty, instantly ripples across the globe.

However, the underlying currents remain powerful. Despite the short-term dips, the core technological and industrial ambitions—the AI data center build-outs, the fundamental growth of decentralized finance, and the re-engineering of supply chains—continue to move forward. The challenge of power infrastructure, while immense, is a call to innovation: it forces collaboration between technology firms, energy providers, and policymakers to develop smarter, more sustainable solutions. Investors and observers should view this period of uncertainty not as a retreat, but as the ground-clearing phase necessary before the next major advance. Resilience, strategic patience, and a focus on essential, long-term infrastructure will ultimately be the keys to unlocking the next decade of economic and technological expansion.

Sources

Binance Square: https://www.binance.com/en/square/post/32539948560610

Bitget News: https://www.bitget.com/amp/news/detail/12560605069445

Thank you !